June 18, 2025

19 min read

Your Guide To The 2025 Chase Sapphire Reserve Refresh

On June 23, 2025, the annual fee for the Chase Sapphire Reserve (CSR) increased from $550 to $795—a $245 hike. This marked the card’s biggest refresh since its original launch in 2016, earning it the nickname “CSR 2.0.” With this jump, Chase positioned the Reserve as the most expensive premium credit card on the market that doesn’t require an invitation. So how did Chase justify the increase? Let’s take a look at what changed, what stayed the same, and what was left behind.

Overview Of Changes

At the launch on June 17, 2025, Chris Reagan, President of Branded Cards at Chase had the following to say:

"The new Sapphire Reserve cards are the culmination of years of focus on the things most important to our cardmembers: travel, dining, entertainment and exceptional service. Both cards offer incredible rewards and benefits centered on our cardmembers’ lifestyles – whether it’s scoring hard-to-get reservations at great restaurants, elevating every aspect of their trips or providing access to amazing experiences."

What's Staying The Same

While much has changed, several core benefits of the Chase Sapphire Reserve remain intact—continuing to offer familiar value for longtime cardholders.

-

$300 Annual Travel Credit - This is one of the most flexible travel credit available as it typically works on anything that codes as travel (e.g. tolls, parking, Airbnb, cruises etc.).

-

Lounge Access - Access for primary card holder with up to two guests to Chase Sapphire lounges, 1,300+ Priority Pass lounges as well as select Air Canada Maple Leaf Lounges and Air Canada Cafés.

-

$420 Worth Value From Doordash – This includes DashPass membership worth $120 annually and $300 worth promos available as a $5 monthly restaurant promo and two $10 promos towards non-restaurant spend such as groceries and retail orders.

-

$120 Lyft Credit - This is available as $10 monthly in-app credit valid through September 30, 2027.

-

Access To Transfer Partners - One of the biggest benefit of holding a Sapphire card is having access to Chase's transfer partners for transferring Ultimate Reward Points at 1 to 1 value which remains unchanged. This includes popular partners such as Hyatt, Southwest, United airlines and Air Canada.

-

3X Points On Dining - This includes worldwide restaurants, eligible delivery services and takeout.

-

Visa Infinite Card Benefits: This unlocks additional benefits such as complimentary status with popular rental car companies (e.g. Avis, National, Hertz), Access to Visa Infinite Concierge Services, Visa Infinite Luxury Hotel Collection and many more benefits.

-

Purchase Protection which includes:

- Purchase Protection for new purchases up to 120 days from date of purchase.

- Return Protection for up to 90 days of purchase.

- Zero liability protection.

- Extended Warranty Protection which extends the time period of the manufacturer's U.S. warranty by an additional year, on eligible warranties of three years or less, up to four years from the date of purchase.

-

Travel Protection which includes:

- $120 statement credit every four years as reimbursement for fees paid towards Global Entry, TSA PreCheck or NEXUS traveler programs.

- Trip Cancellation and Interruption Insurance.

- Emergency Evacuation and Transportation.

- Roadside Assistance.

- Auto Rental Coverage.

- Trip delay reimbursement.

- Travel Accident Insurance.

- Baggage delay insurance.

- Emergency Medical and Dental.

- Lost Luggage Reimbursement.

- No foreign transaction fee.

What's Being Removed

Consumers normally don't like benefits being taken away. This is often called "Loss Aversion" which is a cognitive bias where the pain of losing something is perceived as significantly greater than the pleasure of gaining something of equal value.

In the past year, Chase removed two key benefits, which came as disappointing news to many users.

- Priority pass restaurant credit i.e. $28 to dine at restaurants in airports – plus another $28 for a companion went away. This was a big nerf and beyond Chase's control since every card that relies on Priority Pass lost this benefit across all credit card companies.

- Lyft purchases earning rate was slashed from 10X to 5X. This was a big loss to many users who relied heavily on Lyft for commute and used to earn the highest 10X multiple on this spend.

While there were many rumors of sweeping changes that would take away many more benefits as part of the major refresh, the list of existing benefits that are actually going away is small but highly impactful. The two main benefits being removed are as follows:

3X On All Travel Removed

Going forward, you will only get 1X for any travel spend that is not part of the increased multiplier travel categories like hotels, cars, dining or flights. This means after the $300 travel credit is redeemed, the following spend will earn 1X even if it codes as travel. Please note that the list is not exhaustive:

- Trains

- Transit

- Airbnb

- Third party vacation rental platforms

- Uber/Other non-Lyft taxis

- Bikeshare

- Ferries

- Tolls

- Parking

- Cruises

- Campgrounds

- Online travel agencies

- ...

This is undoubtedly one of the biggest changes/nerf of this refresh. As you can see it removes the 3X multiplier from the broad travel category except a few selected big categories such as hotels, cars, flights or dining. For many users, this makes up a big part of their organic spending.

For example, if this category spend was $10,000 you would have previously earned 30,000 Chase points. Whereas after the refresh you would only earn 10,000 Chase points.

1.5 CPP Chase Travel Portal Redemption Removed

Previously, Sapphire Reserve cardholders enjoyed a flat 1.5 CPP redemption rate on all travel booked through the Chase Travel Portal. This was a fixed multiple that you could count on regardless of the booking made. This was very useful for domestic flight bookings, or to book non-chain hotels and just generally as a good flexible alternative to transferring Chase points to partners.

With CSR 2.0, Chase has moved to a dynamic pricing algorithm called as "Points Boost". In other words, during the booking process Chase's algorithm will boost a few selected bookings that will offer up to 2X points. This is likely to favor premium travel bookings such as EDIT hotels or business class flight tickets. This means no multipliers on budget hotels or economy tickets. In simple terms, this is a devaluation.

What's Changing

Some perks haven’t gone away, but they have evolved—whether in value, structure, or the way you access them. Here's what’s shifting.

Higher Annual Fee

The most significant change is the increase in annual fees. The primary cardholder fee has risen to $795, up from $550—a $245 hike. Authorized user fees have also increased to $195 each, compared to the previous $75, marking a $120 jump.

Point multipliers Are Changing

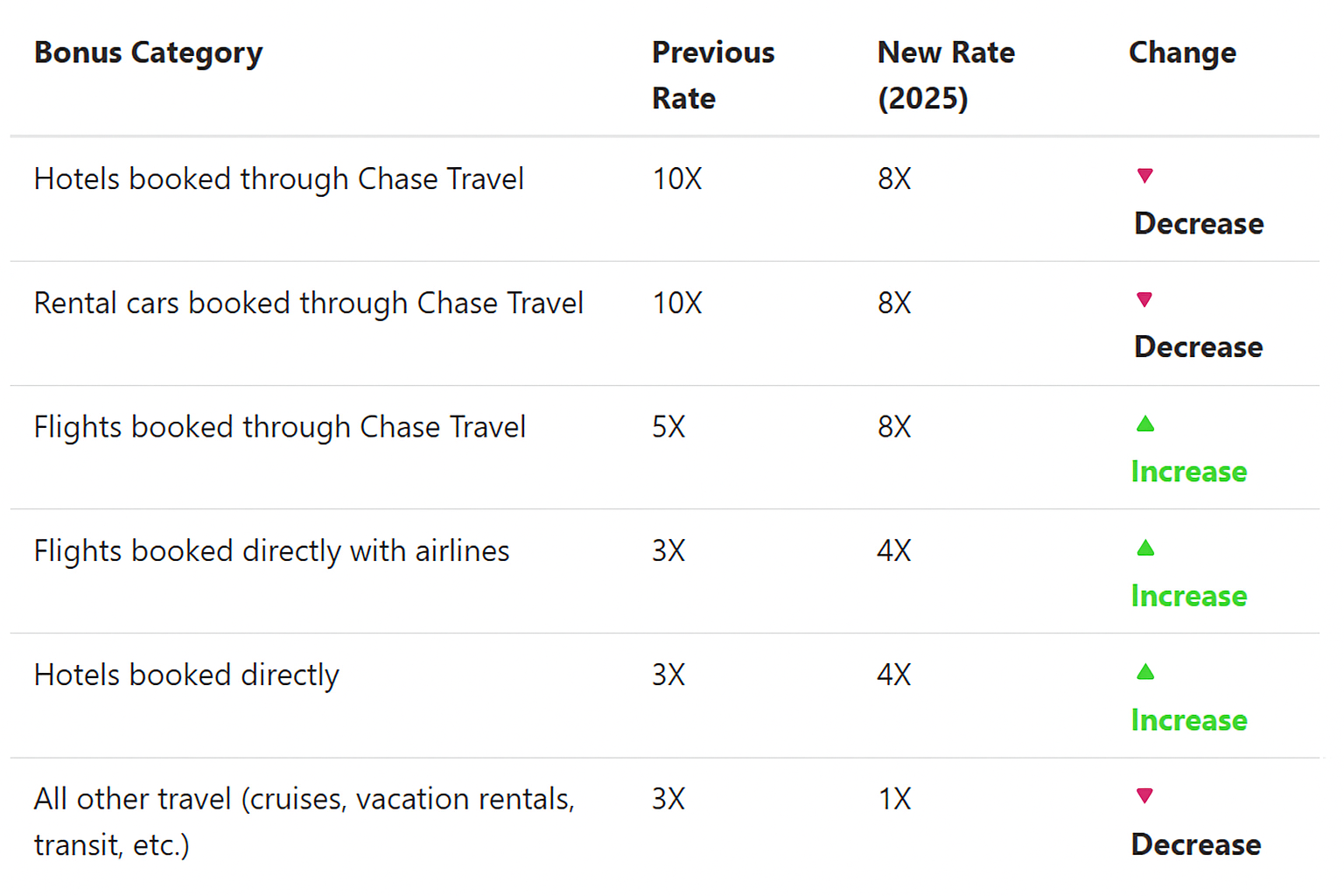

Earning rates for various travel categories have changed as follows:

As we can see, three categories have increased multipliers while three categories have decreased multipliers. The biggest loss is the removal of 3X on "All other travel".

Hold multiple cards within same product category

Chase will allow customers to get both Sapphire Preferred & Sapphire Reserve Cards Starting June 23, 2025. This was previously not possible. This can open up some new options such as using best aspects of both cards as well as being eligible for sign-up bonuses on both cards.

What's New

This is the section that will interest most users as it is intended to justify the price increase with a host of new benefits/credits. These are the latest additions to the card:

- $500 With Edit Hotels By Chase Travel

- Earn up to $500 yearly for prepaid stays with The Edit. A credit of $250 will be applied to a 2-night minimum stay booked at Edit Hotels. This credit can be used twice for a total of two 2-night stays (4 nights total). Each of the 2-night stay reservation must be a separate booking.

- Starting January 1st 2026, Chase made these credits flexible by allowing them to be used anytime during the year whereas previously cardholders were forced to use the two $250 hotel credits split as one credit in each half of the year.

- Note: As a one-time benefit for 2026, Chase is offering an additional $250 credit for prepaid Chase Travel hotel bookings for stays with IHG® Hotels & Resorts, Montage Hotels & Resorts, Pendry Hotels & Resorts, Omni Hotels & Resorts, Virgin Hotels, Minor Hotels, and Pan Pacific Hotels and Resorts. Two night minimum required.

- Some nice perks offered by booking with Edit by Chase Travel include: Welcome amenity, complimentary daily breakfast for two, Room upgrades, Early check-in/late checkout, $100 property credit that can be used for hotel amenities and services like dining, spa etc.

- Some downsides are that Edit hotels are often ultra-luxury hotels—formerly part of the Luxury Hotel & Resort Collection (LHRC) often having nightly rates of $500-$1000+. The footprint is small and there is no clear list from Chase to search through. Given the 2-night minimum, this may not be an easy credit to use for fair value.

- $300 Annual Dining Credit - You can earn $150 every 6 months when you dine at Sapphire Reserve Exclusive Tables, available for booking on OpenTable via the The Visa Dining Collection. If you live in/near a big city, this can be an easy credit to use.

- IHG Partnership Gives Status - This is a limited time partnership through December 31, 2027 that offers IHG One Rewards Platinum Elite status. This is the same status that you would get from holding the Chase IHG One Rewards Credit Card. Note that this status does not offer free breakfast but it can still provide valuable perks such as room upgrades, late checkout, and other on-property benefits. One time enrollment is needed which makes this easy to use.

- $250 With Apple Partnership - This is a limited time partnership through June 22, 2027 that offers Apple TV+ and Apple Music which need to be subscribed individually. Keep in mind that you cannot use it towards an Apple One subscription which would have provided more bundled services (Apple Music, Apple TV+, Apple Arcade, and 50GB iCloud storage) at a lower cost.

- $120 With Peloton Partnership – You can earn 10x points on eligible Peloton equipment and accessory purchases and up to $120 in annual statement credits toward Peloton memberships available as $10 monthly credits. Be aware that the basic Peloton App One membership costs ~$13/month which means you would have to spend at least $36 extra annually since you would have to subscribe to the monthly plan for the credits to apply.

- $300 With StubHub Partnership – You can earn $150 every 6 months for purchases made with StubHub. Depending on your interests, this can be an easy way to score good value tickets for sports, concerts and theater events.

- $300 Worth Access To Reserve Travel Designers - You can build and book a custom itinerary that unlocks hidden gems and new experiences around the world with a Reserve Travel Designer. Chase values this service at $300 per trip. With the rise of AI, it remains to be seen whether this service offers any meaningful value.

- Additional Benefits After $75,000 Annual Spend - If you spend $75,000 on your Chase Sapphire Reserve card in a calendar year, you'll unlock additional benefits like IHG One Rewards Diamond Elite status, a $500 Southwest Airlines credit, A-List status with Southwest, and a $250 Shops at Chase credit. This is a high spend requirement for benefits that only a few users might value especially in light of the removal of 3X multiplier on "All Travel Category".

- New Sapphire Reserve for Business Card - While this is a new product, it has much of the same benefits as the personal Sapphire Reserve card. However, it does have several exclusive business focused credits such as 3x points on advertising purchases, $400 ZipRecruiter credit, $200 Google Workspace credit and $100 Giftcards.com credit.

- New Design - The new card has engraved logos and textured patterns and is heavier (19.6 grams) with the design inspired by facets of a Sapphire gem and the Chase octagon. Interestingly, it also has a brand message at the back of the card that reads

"The most rewarding card"which is new.

Big Picture: Understanding The Updates

When the Chase Sapphire Reserve launched in 2016, it sparked a premium travel card revolution in the credit card industry. The demand was so overwhelming that Chase ran out of metal cards and had to issue temporary plastic versions until new stock arrived.

Given how wildly popular the Chase Sapphire Reserve has been with consumers, let’s take a step back to look at the big picture and understand the overall direction of these updates.

Perceived Value Should Be Greater Than The Annual Fee

Everyone likes a good deal. People want to be part of transactions where they feel they're "getting more than they're giving". This is rooted in biology due to a combination of psychological and physiological factors such as brain chemistry, reward system and social influence.

Consequently, one of the core principles behind credit cards with annual fees is to deliver a perceived value that far exceeds the cost. In this refresh, for example, Chase increased the annual fee by $245—but aims to offset that with over $1,500 in new value, reinforcing the card’s overall appeal.

Ultimately, it's up to each individual to decide whether the benefits outweigh the costs. This calculation can vary greatly depending on factors like location, lifestyle, life stage, and personal preferences.

Coupon Book Benefits

In the world of premium credit cards, Amex can be considered a pioneer in creating a "coupon book" model for credit card rewards which other banks like Chase have adopted. The reason it's often compared to a coupon book is that you prepay the annual fee, and in return, the bank provides a suite of time-sensitive credits ("coupons") that have an expiration. These are use-it-or-lose-it benefits that do not carry over like cash. The credits ("coupons") must be used in order to offset your annual fee. The coupon book style of benefits have proven to be extremely effective since the expiration date encourages customers to make purchases sooner rather than later, thereby increasing sales and driving engagement.

But what happens if you cannot use the credits in a timely manner? In the world of credit cards and rewards programs, "breakage" refers to the value lost when benefits or rewards go unused, expire, are forgotten, or are redeemed for less-than-optimal value. Credit card issuers—especially those with rewards programs—often profit from this unclaimed value.

From the cardmembers side, this increases complexity as it puts a much higher burden on users to track and use all the various credits in a timely manner. For example, there are credits that apply every four years, every year, every six months and every month. This shift towards coupons may prompt many users to move away from travel credit cards in favor of simpler, more straightforward cash-back options.

More Power To Algorithms

One of the clear pattern to emerge from CSR 2.0 changes is that Chase like Amex is moving towards a future powered increasingly by algorithms.

Amex is famously known for the Amex pop-up jail which refers to a situation where American Express approves a new card application but denies the welcome bonus. This is flagged by a pop-up message during the application process. Amex uses this tactic to manage risk and limit rewards, often targeting applicants with frequent card sign-ups or low spending on existing Amex cards. Chase has also now ditched it's longstanding transparent rules like "48 month signup bonus eligibility restriction" in favor of a proprietary eligibility determination i.e. Chase pop-up jail.

Another notable shift, as seen above, is the transition to a new "Points Boost Algorithm"—a dynamic pricing system that replaces the more transparent 1.5 cents-per-point (CPP) model.

Incentive To Move Spending To Chase

A bank’s primary goal is to encourage you to spend using its credit card—and it’s even better for the bank if that spending happens on platforms it controls. That’s exactly what Chase and other issuers are increasingly aiming for. For example:

- The Edit by Chase Travel: This is a collection of hand-picked hotels and resorts by Chase. The $500 Edit credit locks you in to using it exclusively on these properties.

- Chase Travel Portal Multipliers: By providing an 8X multiplier for cars, hotels or flights booked using Chase Travel, there is a strong incentive to use Chase's travel portal.

- Dining Credit: This credit isn’t broadly applicable—it can only be used at Sapphire Reserve Exclusive Tables, a curated selection of restaurants chosen by Chase.

Strategic Partnerships That Incentivize Spending

When consumers spend, everybody wins. Strategic partnerships by Chase creates strong incentives for users to rely on certain services—sometimes even when they don't truly need them.

Many of the new credits may hold little to no value if you don’t already spend with the partnered brands—like Apple, Lyft, StubHub, or Peloton. This is a common scenario for many users. Consider the following use cases:

- You already pay for an Apple One subscription but you cannot use the $250 annual credit towards Apple One since it applies only to Apple TV+ and/or Apple Music.

- You rely on Uber instead of Lyft. Or you rarely use ride-share since you rely on public transportation or your own mode of transport.

- You don't use StubHub since you rarely go to events or you use Ticketmaster.

- You don't use Peloton since you have a gym membership or find Peloton services/equipment to be too expensive and use competing services like Apple Fitness+ with your Non-Peloton equipment.

In all of these cases, the so-called "lifestyle benefits" offer little to no real value if you don't already use these services. However, in an effort to justify the $795 annual fee, you might feel compelled to try them—not out of need, but simply to recoup some of the cost.

On the other hand, if you’re already paying for these services, the new benefits could offer great value—essentially covering costs you would have incurred anyway, now paid for through your CSR benefits.

Creating Own Lounge Network

A growing trend among big banks is the creation of their own airport lounge networks—a movement kicked off by American Express with its Centurion Lounges in 2013, followed by Capital One Lounges in 2021 and Chase Sapphire Lounges in 2023.

This tends to be a huge value driver for premium travel cards since it provides exclusive unlimited access to these lounges which is typically possible only by holding the most premium travel card such as Amex Platinum, Capital One Venture X and Chase Sapphire Reserve.

Perceived Value Of Credits Varies Greatly

It can be argued that many of the CSR 2.0 credits are Urban dweller coupons. You will find it much easier to use the credits if you live in/near large urban areas. For example, Edit hotels, Sapphire Reserve Exclusive Tables, Lyft, Doordash and Chase Sapphire Lounge access are all available primarily in large urban areas.

Additionally, the credits/coupons are with specific industry partners that sound like great value but may end up going unused for many users.

The previous math was simple. For $550 annual fee, you get back $300 on a universal travel credit. This leaves $250 of additional value that you need to get back from various options like Doordash, Lyft, lounge access, 1.5 CPP redemptions etc. With CSR 2.0 however, the math has become more complicated since the perceived value of credits will vary greatly based on individual user preferences.

Providing Time For Transition

For big changes, it is important that consumers get enough time to absorb and react to the new changes. Chase has taken several steps to provide ample time. For example:

- Cardmembers who applied prior to June 23, 2025, will experience these new benefits and features starting October 26, 2025. Their annual fee will be adjusted to $795 on their next anniversary date following October 26, 2025.

- If you apply for, upgrade to or have an existing Chase Sapphire Reserve card before June 23rd, you’ll lock in the 1.5 CPP redemption option for more than two years, until October 2027, for all points earned before October 26, 2025. Points earned after October 26, 2025 will not have the 1.5 CPP redemption option via Chase Travel.

Are The Premium Perks Really Premium

At the end of the day, how would you describe the refreshed Chase Sapphire Reserve Benefits? Do they appeal to you? Does it justify the steep $795 annual fee? Do you think the benefits truly live up to the "premium" label? Would you keep the card, upgrade, downgrade or cancel it? Like in all such cases, the answer perhaps is much more nuanced - it really depends on your lifestyle and what you value. Keep in mind that:

- You are essentially prepaying for benefits that you will claim over the year.

- If it suits your lifestyle, CSR 2.0 can potentially get you well over 3X the value you paid for.

- Services like Doordash have considerable markup versus ordering direct.

- Some of the benefits like Apple and IHG are limited time partnerships that will end in 2027.

- It's easy to lose track of recurring, time-sensitive credits if you don't have a system to manage them.

- If you're not consistently breaking even or getting positive value year after year, this might not be the right card for you.

- At its core, this is a travel card built for travel-related experiences. To truly get your money's worth, you'll need to travel at least a few times a year.

🛠️Tool We Use: The Chase Sapphire Reserve Credit Card is one of the best premium credit card out there. If you’re interested in applying, here’s our referral link — we may earn a bonus if you’re approved. Thanks for supporting the blog and helping us keep sharing valuable travel insights!